Summary Report of the 23rd Board Meeting of the Green Climate Fund – What went down and why it took longer than usual

by Claire Miranda-Balba | info@gcfwatch.org

Note: GCFWatch.org is maintained by the Institute for Climate and Sustainable Cities, with initial support from Heinrich Böll Foundation, Germanwatch, and the German Federal Ministry for the Environment, Nature Conservation, and Nuclear Safety.

The Green Climate Fund (GCF) recently concluded its 23rd Board Meeting at its headquarters in Songdo, South Korea. The meeting on July 6–8, 2019 aimed to deliberate on the approval of 10 new funding proposals (FPs, equivalent to USD 266.9 Million) and 4 accreditation applications (3 direct access entities [DAEs], 1 international entity). However, B23 was particularly important because it aimed to shed light on matters related to the Fund’s replenishment and settle the long-standing issue of the Board’s non-consensual decisions that already led to problematic delays in the GCF’s operations and policies. It was also the first Board Meeting for Yannick Glemarec, who was appointed Executive Director of the GCF at B22.

Replenishment: The race between innovation and ambition

Since last year, “replenishment” has become the buzzword and the central issue of the Fund. At the meeting, the Board spent an ample amount of time discussing the matter, particularly the outcome of the recent consultation meeting held in Oslo, Norway, in April 2019. Johannes Linn, the global facilitator for replenishment, presented the report of the meeting and received positive comments from the Board, mostly from Board Members (BMs) representing contributor countries. While the BMs from Germany and Norway gladly shared their government’s intention to double their commitments, the BM from the US[1] and others from their constituency remained silent.

Conversely, comments from developing country BMs focused on ensuring that the replenishment process will be ambitious.

The BM from Iran emphasized the fact that the process is already delayed and that there is no other option left but to raise the commitments. He also mentioned the developed countries’ fixation on filling policy gaps and how this seemed to be a requirement to double or triple their commitments. The BM from Saudi Arabia supported Iran and strongly expressed, on behalf of his constituency in the Asia-Pacific region, the rejection of contributions that are tied to a number of conditions. He repeatedly said, “Conditionalities for contributions are unacceptable.” The BM from Egypt agreed and pushed for clear indications in doubling the Initial Resource Mobilization, facilitating access, and rationalizing the Fund policies.

Still along the lines of raising ambition in resource commitments, the BM from Tanzania suggested to take advantage of the Climate Summit in New York happening in September 23 this year. The primary purpose is for the process to gain traction and for the Fund to receive the high-level attention it needs. The suggestion was supported by the BMs from Egypt, Liberia, and Nicaragua. GCF Executive Director Yannick Glemarec confirmed that arrangements with the UN Secretary General are already in place to ensure that an ambitious and successful GCF replenishment is one of the key outcomes of the Summit.

The BMs from Saudi Arabia and Liberia also thought it is important for the Board to reflect and develop an appropriate work plan and link the Fund’s 8th Report to the Conference of Parties to the UNFCCC with the outcomes of the replenishment meetings, pledging conference, and the Climate Summit.

When Johannes Linn confirmed that the next replenishment consultation meeting is set to happen in Canada on August 29–30 this year, the BM from Saudi Arabia proposed to hold the next GCF Board Meeting at a later time, possibly after the Climate Summit.

The Replenishment Consultation Meeting also raised the issue about the role of observers—whether or not they can assume a similar function to active observers (AOs) with the ability to intervene—in meetings related to replenishment. The Board was set to decide on the said matter at B23 but was not able to do so because of time constraints.

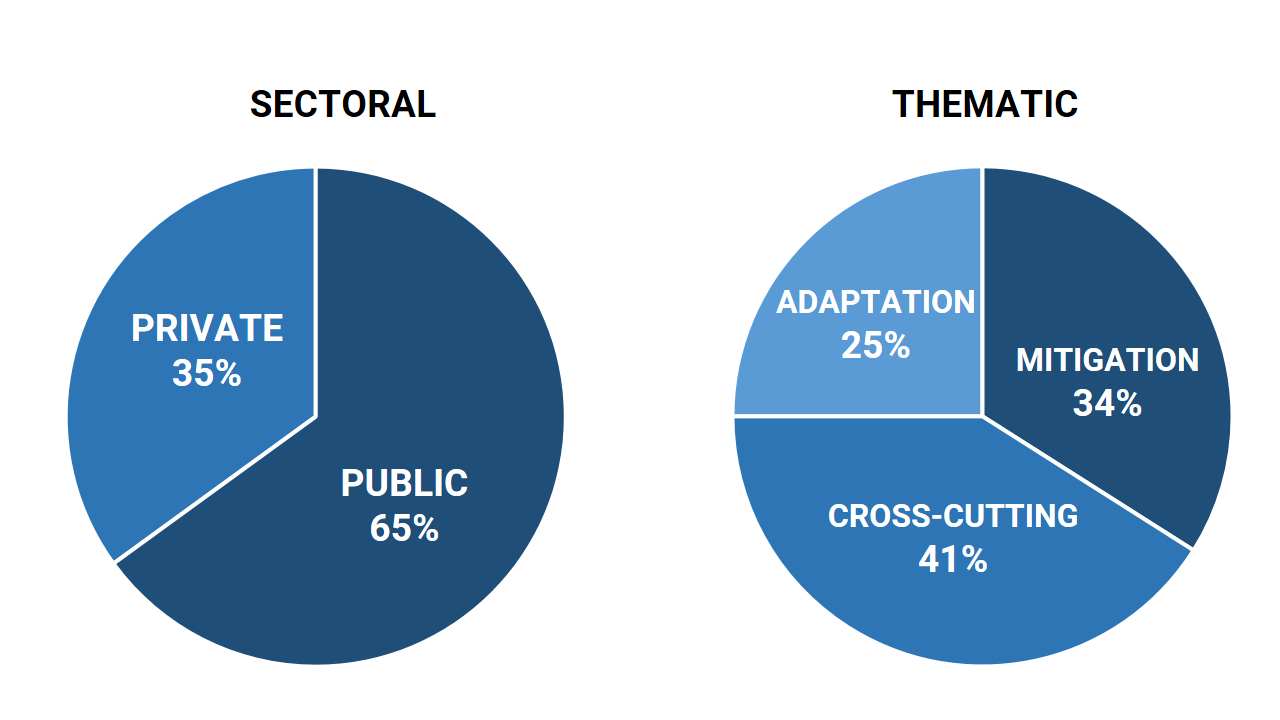

The discussion was followed by an information document, Scenarios for the GCF Replenishment, presented by the GCF Secretariat to outline the programming scenarios developed for the Fund’s first replenishment process (i.e., Continuing Business Scenario, Upper Frontier Scenario, and Pursuit of Impact Scenario). Based on consultations with BMs, the scenario “Pursuit of Impact” was preferred among the three because it was believed to capture the Fund’s vision of supporting country ownership and theory of change. The scenario was also seen to recognize the need to increase support for adaptation and national adaptation plans.

However, as expressed by the developing country BMs, as well as in the statement delivered by the civil society organizations through Julius Ngoma, an alternate AO from the South, the “Pursuit of Impact” Scenario still needs further improvement. The increased role of the Private Sector Facility (PSF) in the goals is inconsistent with the Fund’s objective to become people centered and human rights based. While many developed country BMs see the role of the Private Sector as a direction toward innovation, the developing country BMs fear that the new financial instruments introduced by the PSF can potentially eliminate the grant component of the GCF.

The “Pursuit of Impact” scenario also proposed to increase direct access by increasing the number of projects from DAEs. However, as emphasized in the CSO intervention, if we are looking at the significant amount of funding channeled to only a few international entities, what would truly reflect direct access is if the Fund increases the funding amount allocated to DAEs.

Some BMs also noted that the preferred scenario must be consistent with the principles of the Fund, including the need to focus on adaptation and move away from being mitigation centric. The BM from Egypt raised an important point about the danger of introducing new financial instruments and their tendency to increase the indebtedness of already indebted countries.

Once again, comments from the BMs showed the divide between developing and developed countries. While developed country BMs welcomed the idea of leveraging Private Sector Finance, the developing country BMs feared that new financial instruments under the Private Sector (i.e., lending and insurance guarantees) will eventually undermine the purpose of the GCF. The developed country BMs also consistently raised the need to focus on institutional transformation and improving governance structure. By contrast, the developing country BMs saw this a strategy of setting conditions. Sensing that the scenarios were developed just to appease the contributors, the BM from Saudi Arabia reminded the Board about their accountability. He reminded the Board about how the GCF is the fund of people affected by the climate crisis and that they, as members of the Board, are accountable to them, not to the contributors.

Performance Review of the GCF

The Independent Evaluation Unit (IEU) presented the findings and recommendations of the Fund’s Forward-Looking Performance Review, which the Board was requested to note. The report highlighted how the GCF, being a relatively young organization, has achieved so much. Its principles toward achieving ambitious climate action and structure with BMs equally represented by developing and developed countries have also been impressive. However, there are a number of findings that the Fund needs to work on for it to achieve its full potential.

The IEU reported that access to the Fund takes a while. The entire accreditation process is quite meticulous, requiring more than 1000 days on the average for approval. Delivery concerns and policy overload for entities seeking accreditation were identified as major bottlenecks in the process. The same issues were raised from the approval of FPs, which on the average takes 8.6 months. Delays are similarly brought by compliance on policies, particularly those that have been on standby from Board adoption for quite a while (i.e., Information Disclosure Policy, Whistleblower Policy, Policy on Sexual Exploitation, and Abuse and Harassment).

The amount of GCF financing available was also reported insignificant compared with that of other climate finance institutions and with the amount needed to meet the actual adaptation and mitigation needs of developing countries. Adaptation and mitigation needs in developing countries are estimated to be between US$220 billion and US$1200 billion per year, respectively. Relative to the initial resources mobilized for the GCF, US$10 billion is considerably inadequate.

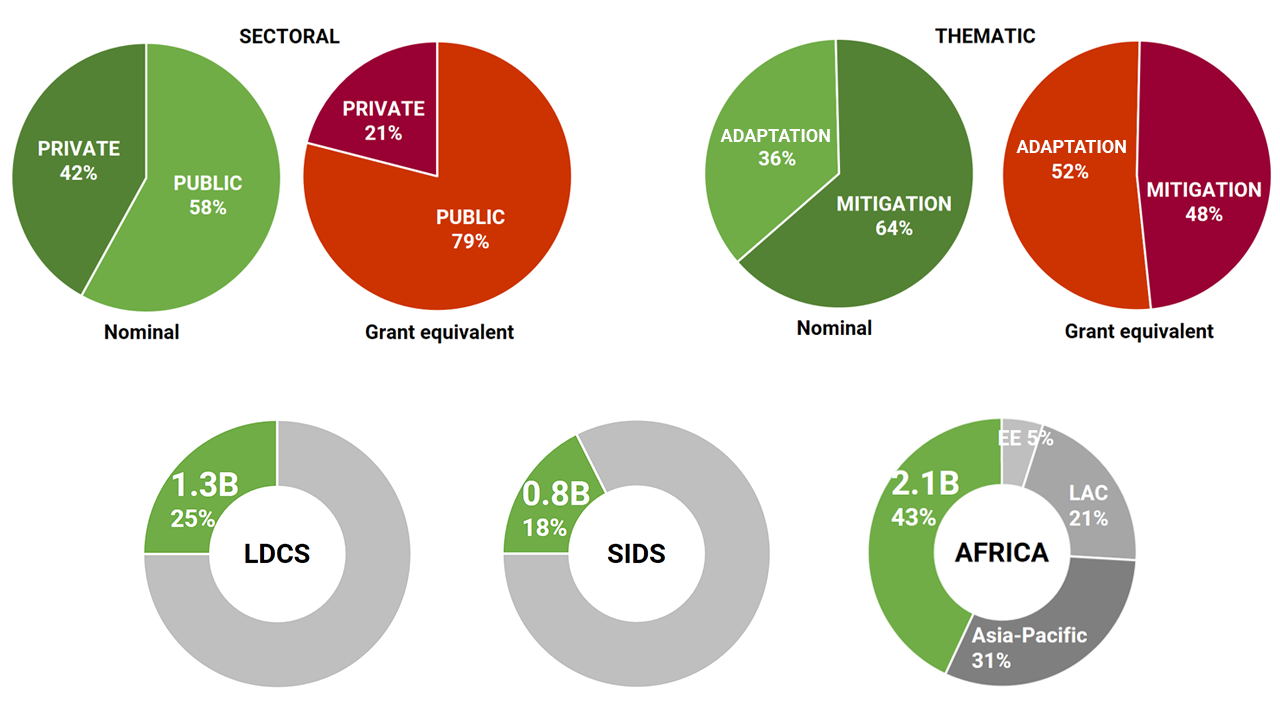

The IEU also cited the stark imbalance of project prioritization toward mitigation over adaptation. Although there are efforts to increase the accommodation of adaptation projects, the reality holds that a large chunk of the Fund was approved to support mitigation projects. To address the imbalance, the IEU recommended the Board to explore Private Sector Finance in adaptation, which was dubbed as a move toward innovation.

Given these, the IEU had the following recommendations:

- New strategic plan that includes creating a climate finance knowledge hub, having a results-based approach in allocating resources, and leveraging the private sector as part of “scaled up and additional finance”

- Better business model with a focus on disbursing through DAEs, including revising the accreditation framework and process

- Reemphasize adaptation while recognizing the role of new actors/innovative Private Sector Finance

- Reexamine supervision and management by delegating authority to the Secretariat for developing procedures, guidelines, and standards for Board-approved policies

Board comments were again divided between the two constituencies. The developing country BMs reiterated the inadequacy of current resource commitments and how this fact sends an alarming message to their respective countries. Some focused on the IEU recommendation of leveraging Private Sector Finance, saying that lending and co-financing instruments have the tendency to do more harm than good. The BM from Saudi Arabia asserted that the financial instruments introduced by the Private Sector to the GCF should remain aligned with the instruments approved under the UNFCCC and the Paris Agreement.

Other developing country BMs mentioned the policy block issue and how it has caused a significant amount of delay in channeling funds to deserving recipients. The BM from Egypt said that the Board is somehow to blame because they tend to device new policies and overlook the fact that many people have been waiting for the much-needed climate finance in order to survive. The BM from China was direct in saying how the Board tends to delay the adoption of policies and decisions because of respective political agenda. He reiterated the need for more resources and urged the Board to move away from its fixation with improving policies to improving Fund efficiency.

Recognizing the need for more resources, some developed country BMs said that the Fund needs to shift its target funding amount from billions to trillions and added the crucial role that the Private Sector has to take to achieve this target.

In our CSO intervention delivered by Helen Magata, the alternate AO from developing countries, we raised our concerns on how Private Sector Finance is praised and endorsed in the report. We believed that “scale and additional finance” has to come first through greater financial resources from contributing countries, particularly developed countries, and that “innovation” should not focus the conversation on the private sector only. True innovation at this stage would mean embracing full-cost financing, working through direct access, and ensuring funding flows to local communities through regranting mechanisms.

Policy on Ethics and Conflict of Interest for Active Observers

At its 13th Board Meeting, the Board requested the Ethics and Audit Committee to extend the policies on ethics and conflict of interests to AOs. The Policy had been repeatedly deferred but was finally presented and adopted at B23 after deliberations by the Board.

The developed country BMs served as allies of the AOs in this discussion as many of them recognized the important insights and contribution of observers to the Fund. The BM from Norway wanted to adopt the policy with minor revisions on the prohibition of gifts for AOs, saying that based on how CSOs generally operate, the policy should not prevent them from receiving travel support from other organizations. The BMs from the US and Germany agreed, together with the BMs from Armenia and Belize, who were all in favor of the active and constructive participation of observers in all GCF processes.

The developing country BMs disagreed and pushed for the need to set limits. The BM from Saudi Arabia have always opposed our CSO interventions, especially those that expose the negative side of entities seeking accreditation. He disagreed with allowing AOs to freely deliver interventions that mention the names of institutions and/or governments and said that past CSO interventions are judgmental and “tarnish the reputation” of entities. The BM from Egypt agreed and urged the Board to ensure that neutrality must be maintained at all times.

After the amendments on gifts, disclosure of information, and the provision that mandates the AOs to maintain neutrality in comments and interventions, the Board adopted the policy.

Status of the GCF Portfolio: Resources and Performance

Similar to previous Board Meetings, the Secretariat presented an overview of where the Fund was at the moment in terms of resources, disbursements, and projects in the pipeline. Below are the figures as of June 30, 2019:

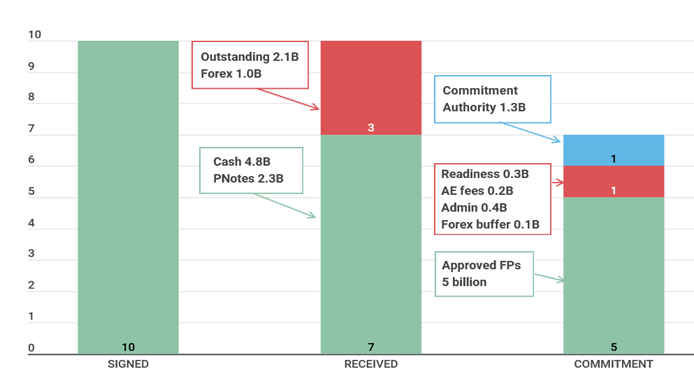

Status of GCF Resources

- A total of US$10.2 billion amount of signed contributions. US$7.1 billion was received (US$ 4.8 billion in cash, US$ 2.3 billion as promissory notes) received.

- US$2.1 billion outstanding from signed contributions, and US$1 billion allocated for forex losses

- Of the US$ 7.1 billion, US$ 5 billion allocated to FPs (as of B22), US$1 billion to readiness and project preparation facilities, accredited entity (AE) fees, administrative budget, and forex buffer.

- S$1.3 billion commitment authority

Status of the GCF Portfolio

- As of June 30, 2019, there are 101 approved FPs worth US$5 billion.

- Of the FPs approved, 56 FPs are under implementation worth US$2.4 billion, and 48 FPs have received a total of US$565 million.

Status of the Pipeline

- The Fund received US$15.7 billion worth of concept notes

- FPs in the pipeline amount to US$3.4 billion

- Africa has the greatest number of FPs in the pipeline at 48%, followed by Asia-Pacific and Latin America and Caribbean (LAC)

- On Simplified Approval Process (SAP) as of B22, 6 SAPs were approved, and 2 have undergone disbursement.

Funding Proposals

The Board approved US$266.9 million worth of FPs in this meeting. Although the batch of FPs were geared toward favoring public financing, mostly in the form of grants and under the adaptation theme, the BMs were appalled to know that none of the 10 FPs came from DAEs despite the repetitive call to increase the number of proposals from DAEs in the past.

The developed country BMs were pleased to see improvements in the compliance with Fund policies on information disclosure, gender, and measures to avoid fund misuse in this batch of FPs. They also commended the strong adaptation component in the FPs and how they offer “nature-based” solutions as part of climate action.

The developing country BMs agreed with the call to have more adaptation projects and hoped to see similar proposals coming from DAEs in the future. However, they refused to dwell on the policy improvement of FPs as they believe that these have only stalled the approval of other FPs. They were also united in requesting the Board to approve all the FPs in one go to save time. The BM from Saudi Arabia said that the Board must learn to trust the recommendations by the Independent Technical Advisory Panel (ITAP) and the Secretariat and start implementing the recommendation of the IEU in delegating tasks.

The request to approve all 10 FPs as a package was rejected by the co-chair who argued that reviewing each FP is the main business of the Board. He reminded the BMs from developing countries how hard the AEs have worked on each proposal and urged them to take the time in at least hearing what each FP is about.

As the Board pointed out their overarching comments to the 10 FPs, it was only the CSOs, in the intervention delivered by Liane Schalateck, the AO from developed countries, who mentioned the alarming dominance of international access entities (IAEs), especially for this batch of FPs. She emphasized how the FPs for this Board Meeting reinforced the imbalance within the GCF’s portfolio, with the overwhelming majority of the GCF funding being channeled through IAEs (4.5 billion for 86 projects or 84% of total GCF funding) while only 16% or only 26 projects are channeled through DAEs. In addition, the CSOs mentioned the strong focus on insurance schemes for small farmers in a number of FPs. We argued that social protection schemes must be considered in all adaptation proposals.

When the Board went through each of the FPs, a number of issues were raised. These issues included transboundary risks that may arise in the Pakistan project, safeguard and FPIC compliance in Ecuador, human rights violations in Honduras, and compliance with Fund policies on gender and information disclosure. The Board also spent time deliberating the loan component of the Ghana (FP114) project, which elicited negative reactions from the Board and thus prompted the AE to revise and restructure the FP during the Board Meeting.

Nevertheless, all 10 FPs were approved. The Board deliberation for each FP is summarized as follows:

Funding Proposal |

Theme |

Amount |

Discussion |

| FP107 UNDP Bhutan

Supporting Climate Resilience and Transformational Change in the Agriculture Sector in Bhutan |

Adaptation | 25.3 million | The BM from Norway wanted to clarify the estimated CO2 reduction estimates. UNDP promised to send information as they go along with the project. |

| FP108 FAO Pakistan

Transforming the Indus Basin with Climate Resilient Agriculture and Water Management |

Adaptation | 35 million | BMs from Nicaragua and Norway feared that the water supply in Pakistan for this project may imply transboundary risks with Afghanistan. FAO assured the Board that no such risks will arise in the project. |

| FP109 UNDP Timor-Leste

Safeguarding rural communities and their physical and economic assets from climate induced disasters in Timor-Leste |

Adaptation | 22.4 million | |

| FP110 UNDP Ecuador

Ecuador REDD-plus RBP for results period 2014 |

Mitigation | 18.6 million | The BM from Japan requested further information about the safeguard measures to cover for damages brought by the FP’s forest activities. The UNDP explained that the FP followed the standard safeguards set by UNDP, which are also aligned with the GCF standards.

The CSO Intervention c/o Lidy Nacpil raised the feedback received from communities in Ecuador about FPIC not being recognized by the government and how oil concessions and activities prevail and destroy IP land and areas with high biodiversity. UNDP assured the Board that they have enough evidence to prove that FPIC was executed in the proposal and that they are committed to implementing it throughout the project cycle. |

| FP111 IDB Honduras

Promoting climate-resilient forest restoration and silviculture for the sustainability of water-related ecosystem services

|

Cross-cutting | 35 million | The CSO Intervention delivered by Lidy Nacpil stirred a debate among the BMs. The statement raised the issue of human rights violations among environmental and human rights defenders in Honduras and cited the demise of Berta Caceres as an example. We urged the project proponents to implement measures that will guarantee the safety and security of human rights defenders. We also suggested that the GCF and IDB exercise zero tolerance on attacks against them.

The BM from Saudi Arabia requested the Board to give the government of Honduras (via the NDA) the chance to respond to the accusation about human rights violations and expressed his dismay once again to CSOs giving judgmental interventions. The BM from Tanzania agreed and encouraged the NDA present to shed light on the political context and other matters distinct to their country. The BM from Nicaragua echoed the call and said that the GCF is not a human rights council. The BM also suggested to limit the interventions based on the merits of the FPs. A special envoy from the Government of Honduras responded and assured the CSO Active Observers that they share the same concerns about the human rights violations happening in their country and that they will do their best to prevent such cases. The representative also shared some of the government’s international commitments regarding human rights. The co-chairs agreed with the BM from Saudi Arabia and requested the Board and observers to comment on the FPs itself and not go beyond other issues. |

| FP112 UNDP Marshall Islands

Addressing Climate Vulnerability in the Water Sector (ACWA) in the Marshall Islands |

Adaptation | 18.6 million | |

| FP113 IUCN Kenya

Towards Ending Drought Emergencies: Ecosystem Based Adaptation in Kenya’s Arid and SemiArid Rangelands |

Adaptation | 23.2 million | The BMs from the Netherlands and Tanzania were pleased to support and noted the strong adaptation component of the project. However, in our CSO intervention, Lidy Nacpil raised concerns about the governance structure and the project steering committee indicated in the FP that did not include any pastoralist organizations and county governments. It was also not clear whether IP groups were consulted and included in the process and whether peace building activities were considered, especially because many of the project sites are located in conflict areas. |

| FP114 AfDB Ghana

Program on Affirmative Finance Action for Women in Africa (AFAWA): Financing Climate Resilient Agricultural Practices in Ghana |

Cross-cutting | 20 million | While the Board welcomed the overall objective of the project as it aimed to provide financial support to women entrepreneurs in climate resilient farming and agricultural activities, many raised concerns with the financial instrument proposed by the project. From the total requested amount of US$20 million, US$18.5 million will be in the form of loans, and the rest will be allocated for technical assistance.

The BM from France questioned the affordability of the products offered to the recipients to justify the intended allocation. The BM from Tanzania felt strongly against the loan component, considering that the target recipients are women from one of the most impoverished communities. Many BMs expressed the same sentiment, saying that rather than helping, the FP may leave the women indebted. AfDB responded and assured the Board that the recipients will be assisted by the entity via guarantees. Still not convinced, the Board suspended the approval of the project, to which the AfDB amended the proposal and proposed to convert US$5 million into grants. This stirred another round of debate from the Board. The BM from the US sought clarity on what the adjustment implies—whether these grants will be intended for financial institutions or for the recipients. The BM from Canada asked what the amendment entails, not only in terms of seeking no-objection from the NDA but also in terms of setting precedent for other FPs that may raise similar issues. Despite the concerns raised, the BMs from China, Nicaragua, and Saudi Arabia were eager to approve the project and asked the Board to trust the adjustments with the ITAP and Secretariat after noting the concerns raised. The co-chair suggested to suspend the approval of the FP to give AfDB the time it needs to make amendments. On the last day of the Board Meeting, the Board approved the project with the condition that the AfDB consult the NDA in increasing the grant component (US$5 million) of the project. |

| FP115 MUFG Chile

Espejo de Tarapacá |

Cross-cutting | 60 million | The FP received positive comments from the Board, including our CSO intervention delivered by Liane Schalateck. However, some raised concerns about maintaining the environmental and social standards of the project as soon as the GCF ends its investment. The Secretariat assured the Board that the community agreement between the MUFG and the affected community will hold in accordance with Chilean laws throughout the project cycle. |

| SAP 007 WFP Zimbabwe

Integrated Climate Risk Management for Food Security and Livelihoods in Zimbabwe focusing on Masvingo and Rushinga Districts |

Adaptation | 8.9 million | |

| FP015 Restructuring of the Proposal UNDP Tuvalu

Tuvalu Coastal Adaptation Project |

FP015 is presented to the Board for the approval of its Project Restructuring in Output 2. Changes in the project baseline of target sites between the time of design and the start of implementation were carried out and would only affect budget reallocation.

The Board easily approved the restructuring, with the BM from the US requesting the Secretariat to ensure that all adjustments done must be compliant with the Fund’s policies, as well as with the information disclosure policy. |

Accreditation Proposals

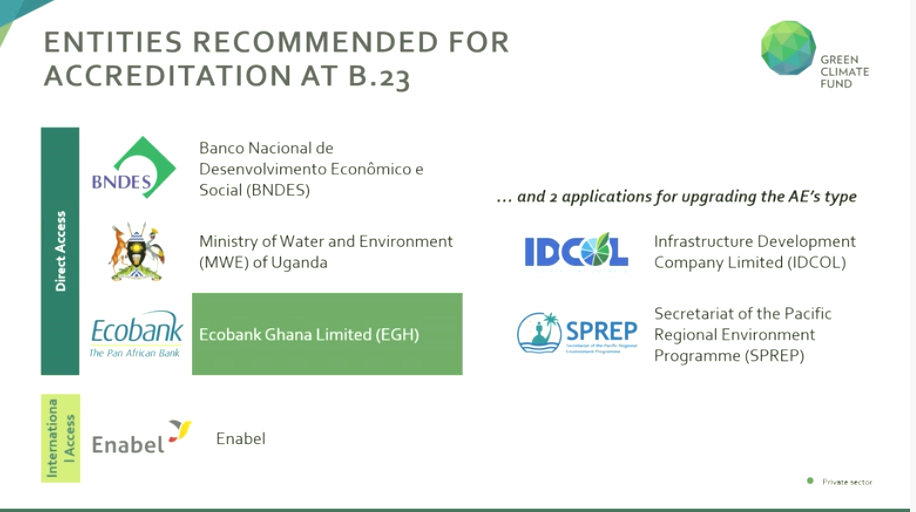

The Board was presented with four new entities seeking accreditation to the Fund (three direct access and one international access) and two DAEs for upgrade. There were no objections from the Board, and the following entities were accredited and approved for upgrade:

The Secretariat reported the latest status of GCF Accreditation, which had the following findings as of May 2019:

- 84 entities have been accredited while 223 are in the pipeline,

- 9 AEs have requested an upgrade, and

- 248 DAEs have been nominated for accreditation by the NDAs, and 117 of these have started the application process.

The Secretariat also reported that measures to increase the application of DAEs are in place. These measures include visits to the GCF headquarters, participation in global programming conferences, and technical assistance for proposal development. However, the BM from Tanzania argued that the pace of approving applications must be improved as the number of DAEs endorsed by the NDAs as presented by the Secretariat is growing.

Updated Accreditation Framework

At B22, the Board decided to streamline the accreditation process to accelerate the review and consideration of entities applying for accreditation. At this meeting, the Board was requested to take note of the results of the review and adopt the updated Accreditation Framework (AF), which is set to take effect on January 1, 2020. The updated AF includes establishing a roster of external consultants, budget, new working modalities of the Accreditation Panel, and the pilot implementation of the Project Specific Assessment Approach (PSAA).

The matter was deliberated quite extensively by the Board. Reiterating the fact that the accreditation process is a major bottleneck in Fund delivery and operations, the BMs from developed countries repeatedly raised the need to improve the system and streamline activities that will help increase the accreditation of DAEs, especially those from least developed countries and small island developing states. The BMs also stated that the PSAA can address these issues and possibly complement the leveraging private sector finance.

Other BMs had a different take. The BM from Saudi Arabia said that he is not ready to adopt the document and that the decision should be deferred. He further explained that a number of entities in the pipeline must be accredited sooner than later and that the introduction of the PSAA will just delay their accreditation and go against the right to development of the most vulnerable countries, which for him have the right to emissions.

Our CSO intervention delivered by Liane Schalateck outlined the risks of the PSAA and how such approach would be unfair for entities that have undergone the tedious process of accreditation. The PSAA would compromise the Fund’s ability to achieve its objectives and ensure the respect of environmental and social safeguards, the Fund’s reputation, and the Fund’s finances. The CSO statement also urged the Board to restrict the PSAA to micro scale projects and DAEs so that international access can no longer take advantage of the “easier” and faster approach.

The Secretariat took note of the concerns raised by the Board and later presented a revised version that deleted the entire section on the PSAA. The new decision text suggested that the accreditation process is considered complete upon the effectiveness of the Accreditation Master Agreement (AMA) and that such date of effectiveness shall serve as the start of the accreditation term for all entities accredited to the GCF, including those accredited prior to the date of the decision.

Some of those who welcomed the PSAA requested the Board to reconsider the approach, especially for the BM from Tanzania who spent an ample amount of time working on it. The text was reconsidered, and it prompted another round of consultations and textual amendments.

After long discussions and offline consultations, the Board approved the revised text on the effectivity of the accreditation terms as earlier presented by the Secretariat, as well as the provision that prioritizes entities—DAEs nominated by NDAs, private sector entities in developing countries, entities responding to RFPs, AEs seeking fulfillment of conditions, and AEs requesting upgrades. The decision to adopt the new AF, the implementation arrangements, and the budget were deferred to B24.

Decision Making in the Absence of a Consensus

Since the 3rd Meeting of the Board, measures to resolve disagreements and decisions that did not receive consensus from the Board have already been proposed. However, this item has been deferred numerous times because the Board still cannot arrive at a consensus, causing serious implications in the adoption of Fund policies and the approval of FPs.

Prior to B23, there was a strong call to settle the matter, and the co-chairs decided to take the lead in conducting consultations.

Ironically, arriving at a consensus for this item had been difficult as it forced the Board to stay up until 3 am to make a decision. Although many agreed on the proposed procedure of voting as a last resort should the Board fail to arrive at a consensus, others had varying views in terms of the scope of the procedure, the determination of whether or not all efforts have been exhausted to trigger the voting procedure, and the procedure itself, particularly with regard to the majority threshold required for a decision to be considered.

The Board was unanimous in saying that the matter needs urgent action as it has led to several delays in policy adoption and disapproval of some of the FPs. However, the developed versus developing country divide was again evident in the discussion of this item.

The developed country BMs emphasized the need to decide on the voting procedure, saying that it will improve the Fund’s governance problems and address barriers in policy adoption. Others dwelled on boosting the confidence of the GCF to do business and potentially inviting additional financial resources from the private sector. Many agreed with adopting the text as it is, including the proposed two-thirds majority threshold in the voting procedure.

The BMs from developing countries went into the finer details of the text. Previous versions of the proposal explored the option to link the votes with contributions, thereby prompting the developing country BMs to secure a just majority threshold. Many of them proposed to increase the majority voting threshold to four-fifths among BMs and four-fifths within each constituency.

The BM from Egypt requested a list of procedures to be undertaken by the co-chairs that will support the trigger to implement a voting procedure. This list was repeatedly requested prior to B23, and it has yet to be provided by the co-chairs in the latest version of the text.

The BM from Saudi Arabia had specific textual edits, covering exceptions to the voting procedure (i.e., any decision that would contradict the rules of procedure and any decision that would limit the use or resources of the Fund) and the eligibility of alternate BMs acting as representatives of the BMs in voting.

At some point, the developed country BMs encouraged their colleagues to adopt the text as it is. They said that it is better than having no procedure at all. However, the developing country BMs reacted negatively and said that agreeing on a compromised text will never be an option for them. The BM from Egypt appealed that the items they want to secure in the text are crucial because as BMs from developing countries, they lack the resources and capacity to go through all the Board documents and having a procedure that would respect the views of their constituency is important for them.

After prolonged consultations and back-and-forth text revisions, the Board agreed (at 3 am) on a procedure, which had the following salient points:

- The co-chairs will determine whether all efforts at reaching a consensus have been exhausted;

- On determination, the majority voting threshold is at least four-fifths of the BMs present and voting;

- On scope, any policy decision on financial instruments and financial terms should be voted on the basis of the consensus. Decisions may include the following:

- The access of certain developing country or countries to financial instruments or financial terms from the GCF (as proposed by the BM from Iran),

- Any decision that may cause conflict between the GCF and the UNFCCC/COP,

- Any decision that amends the Rules of Procedure, and

- Any contribution policy that allows for geographic or sectoral restrictions (to prevent earmarking).

- On voting procedure, each BM is entitled to one vote, and if at least four-fifths of the BMs present are in favor of the decision, it shall be adopted, unless there are oppositions from four or more BMs from either constituency.

Other matters: some adopted, some deferred

Because the Board spent a significant amount of time arriving at a consensus on the items explained above, a number of other items were easily adopted, and some were deferred to the next Board Meeting.

Adopted |

Deferred |

| 1. Compliance Risk Policy

2. Standards for the Implementation of Anti-Money Laundering and Countering the Financing of Terrorism Policy 3. Co-chairs report, including workplan 4. Policy on Sexual Exploitation, Abuse and Sexual Harassment (including cost implications of the SEAH Policy) 5. Integrity Policy |

1. Review of the initial modalities for the private sector facility

2. Guidelines on decisions without a Board Meeting 3. Updated Gender Action Plan |

Date and venue of the next Board Meeting

Taking into consideration the replenishment consultation meeting set in August 2019 as well as the Climate Summit in September 2019, the Board decided to hold its 24th Board Meeting on 12–14 November 2019 at the GCF headquarters in Songdo, South Korea.

DOWNLOAD PDF VERSION HERE

**

Footnotes:

[1] Under the Obama administration, the US committed to contribute US$3 billion to the GCF, and it delivered a total of US$1 in January 2017. Under the Trump administration, the remaining commitment of US$2 billion has been cancelled following the withdrawal of the US from the Paris Agreement.

Correction (05 Aug 2019):

“Updated Gender Action Plan” was moved to the list of deferred board agenda items. In the earlier version, this was placed under the adopted items column.